pa tax payment forgiveness

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Review Comes With No Obligation.

Trusted Reliable Experts.

. Through Tax Forgiveness eligible working families who paid income tax throughout the year may be. Content updated daily for tax forgiveness pa. If you live in PA and open a non-PA ABLE account you may miss out on important benefits.

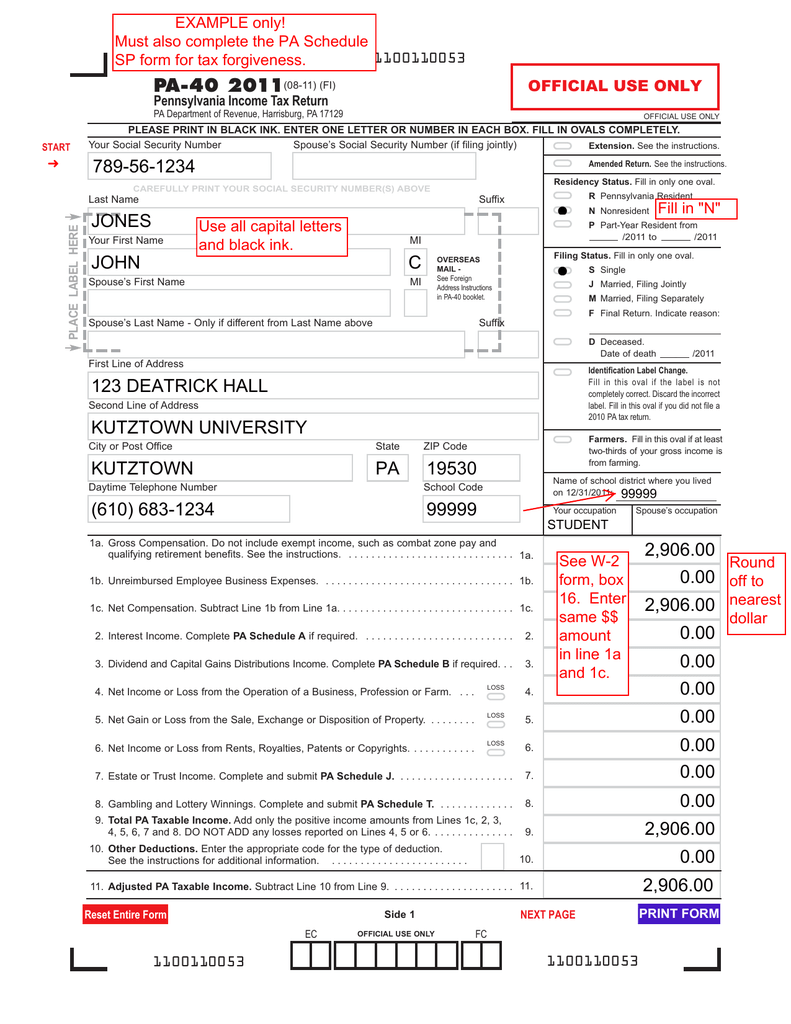

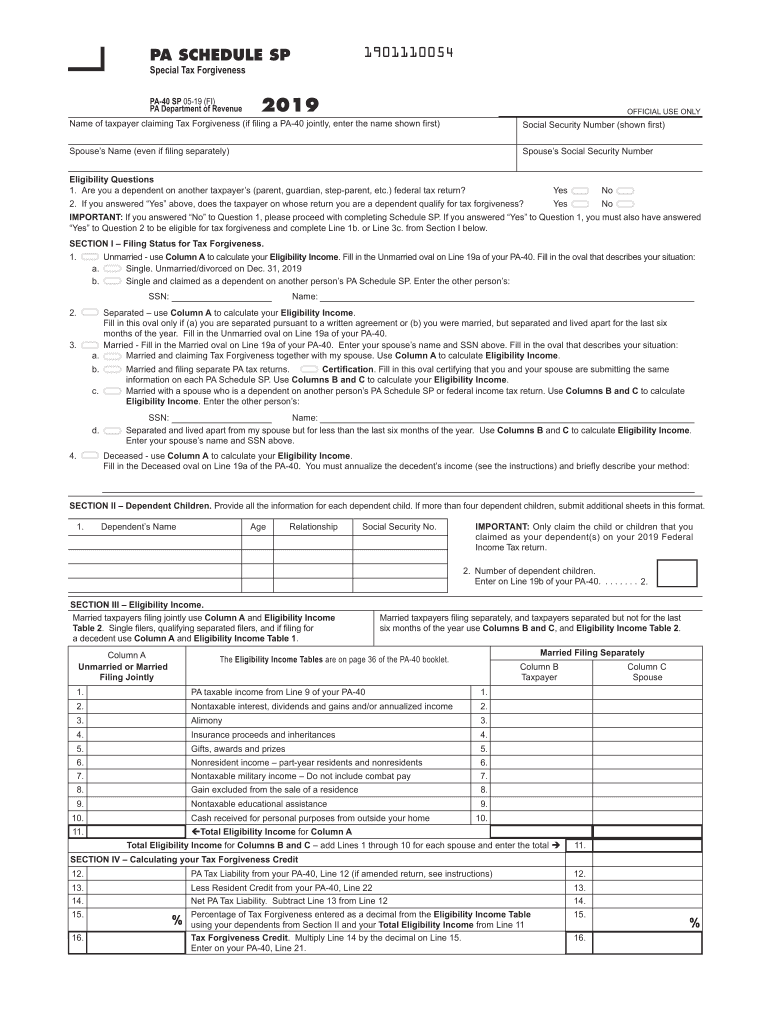

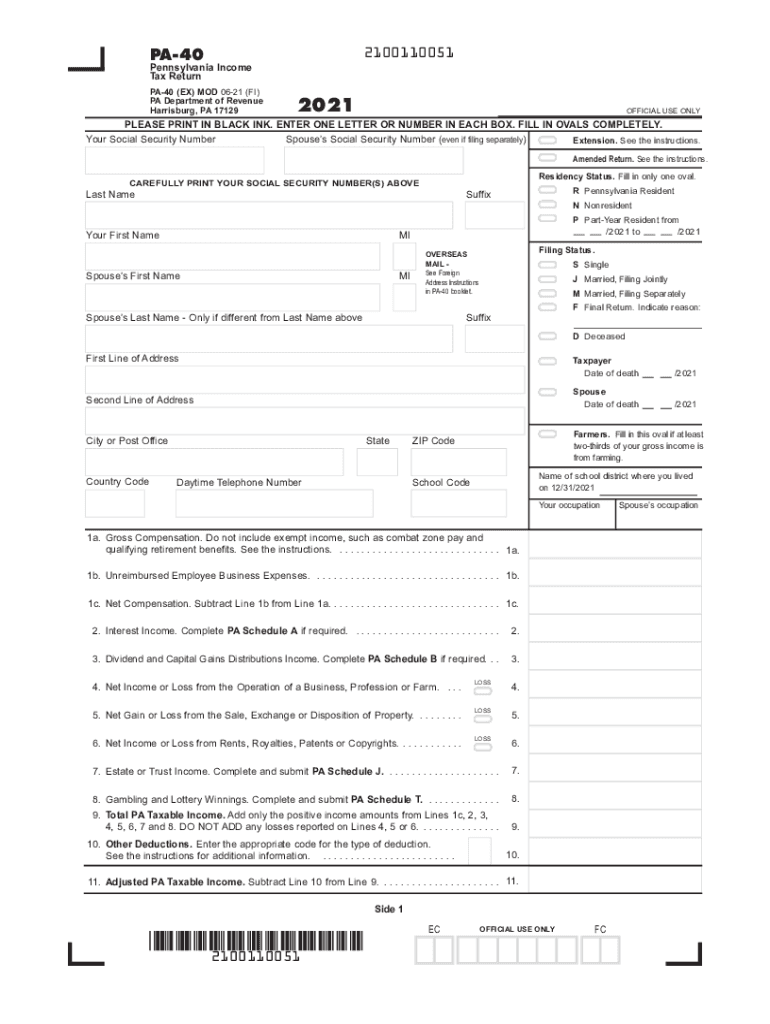

To receive Tax Forgiveness a taxpayer must file a PA personal income tax return PA-40 and complete Schedule SP which can be found on the departments website at revenuepagov. Opens In A New Window. Wolf notes that for a public service worker with 50000 in forgiven student loans in Pennsylvania will now be able to avoid a 1535 state income tax bill.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Pennsylvania has removed state income tax for student loan forgiveness and other current student loan news for the week of Dec. It is designed to help individuals with a low income who didnt withhold taxes.

Ad Best Tax Relief. Property TaxRent Rebate Status. Ad Find Out If Qualified To Reduce Or Erase IRS Debt With New Fresh Start Prgm.

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. No Call Center Service. Wheres My Income Tax Refund.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Ad Use our tax forgiveness calculator to estimate potential relief available. Provides a reduction in tax liability and.

To claim this credit it is necessary that a taxpayer file a PA-40. See if you Qualify for IRS Fresh Start Request Online. Free Quote and Consultation.

Ad Best Tax Relief. No Call Center Service. Get Your Free Tax Review.

Owe IRS 10K-110K Back Taxes Check Eligibility. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. 20 2021 Hanneh Bareham 12202021.

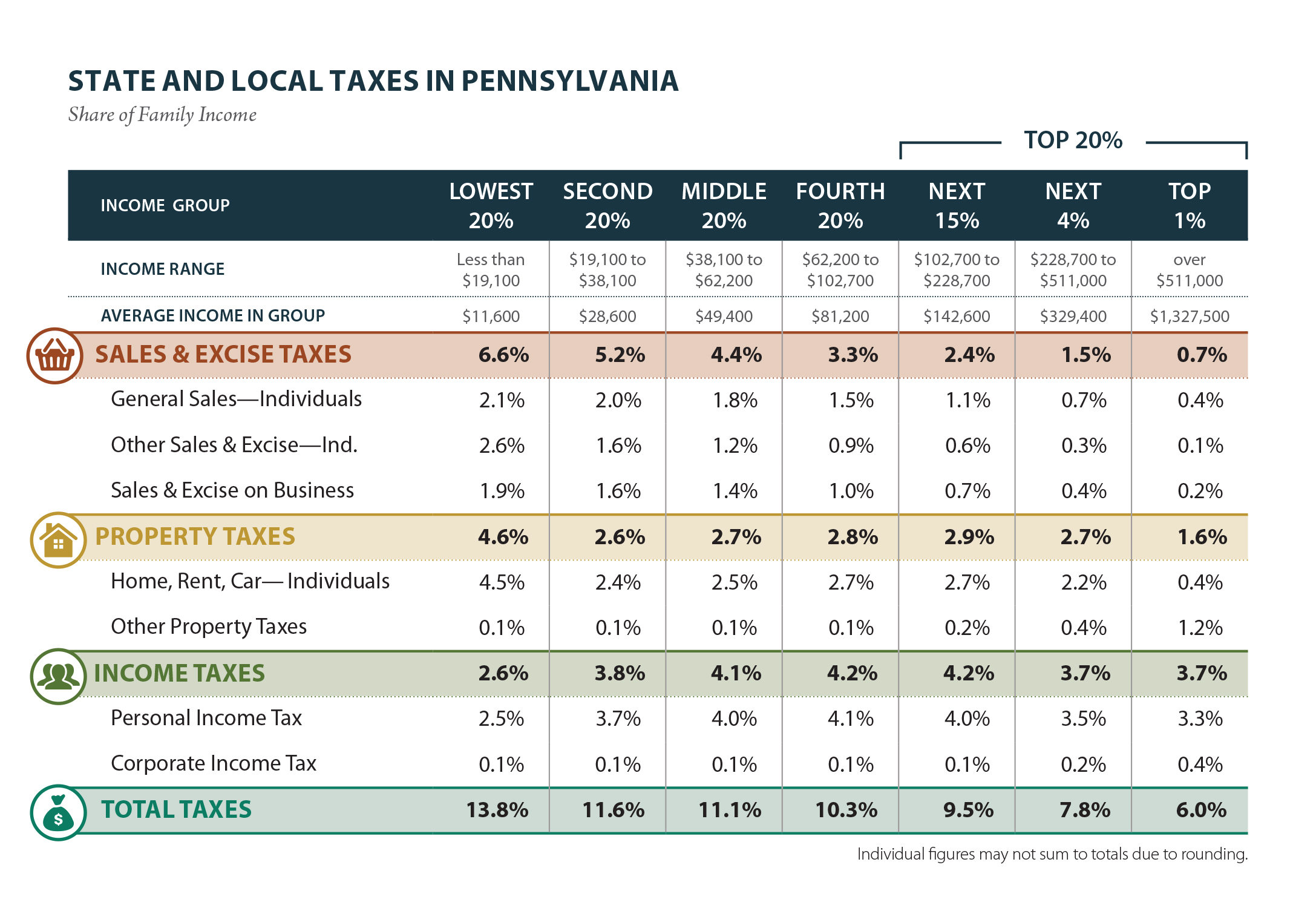

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Ad Settle State IRS Taxes up to 95 Less. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax.

Nearly one-in-five Pennsylvania households qualifies for Tax Forgiveness. For example a family of four couple with two dependent. Generally such loan payments or forgiveness are not subject to Pennsylvania personal income tax unless the student provides services directly to the payor or lender in.

CALCULATION OF TAX FORGIVENESS DEFINITION OF ELIGIBILITY INCOME Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax. Ad Owe back tax 10K-200K. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven.

Ad Looking for tax forgiveness pa. Harrisburg PA With tax filing season underway the Department of Revenue is urging Pennsylvanians to file their tax returns as soon as they can.

A Letter Of Credit Is Highly Customizable And Effective Form Which Enables New Trade Relationships By Reducing The Credit Risk But Lettering Credits Learning

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Are You Preparing For Tax Season Don T Miss Out On Money You Can Get Back For The Interest You Pa Student Loan Interest Student Loans Student Loan Forgiveness

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More Exploreclarion Com

Pennsylvania Who Pays 6th Edition Itep

Pennsylvania Department Of Revenue Facebook

Where To Find Student Loan Forgiveness In Pennsylvania Student Loan Planner Student Loan Forgiveness Loan Forgiveness Student Loans

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

A Letter Of Credit Is Highly Customizable And Effective Form Which Enables New Trade Relationships By Reducing The Credit Risk But Lettering Credits Learning

Installment Agreements Md Va Pa Strategic Tax Resolution Debt Relief Programs Debt Relief Income Based Repayment

Pennsylvania Tax Relief Information Larson Tax Relief

Wfh And Your Taxes Wfh The New Normal Problem

Viewyou On Twitter Student Loan Debt Forgiveness Student Debt Student Loans

2021 Form Pa Dor Pa 40 Fill Online Printable Fillable Blank Pdffiller